Quantum Computing: What's Changing in the Tech World? The Race to $100 Billion Just Got Real

Remember when quantum computing was that buzzword tech CEOs would drop during earnings calls to sound futuristic? Yeah, those days are officially over. The past 72 hours have delivered a wake-up call so loud it's echoing through Silicon Valley and Wall Street simultaneously – quantum computing isn't coming anymore, it's already here, and everyone's suddenly in a massive hurry not to get left behind.

The $550 Million "I'm Not Messing Around" Move

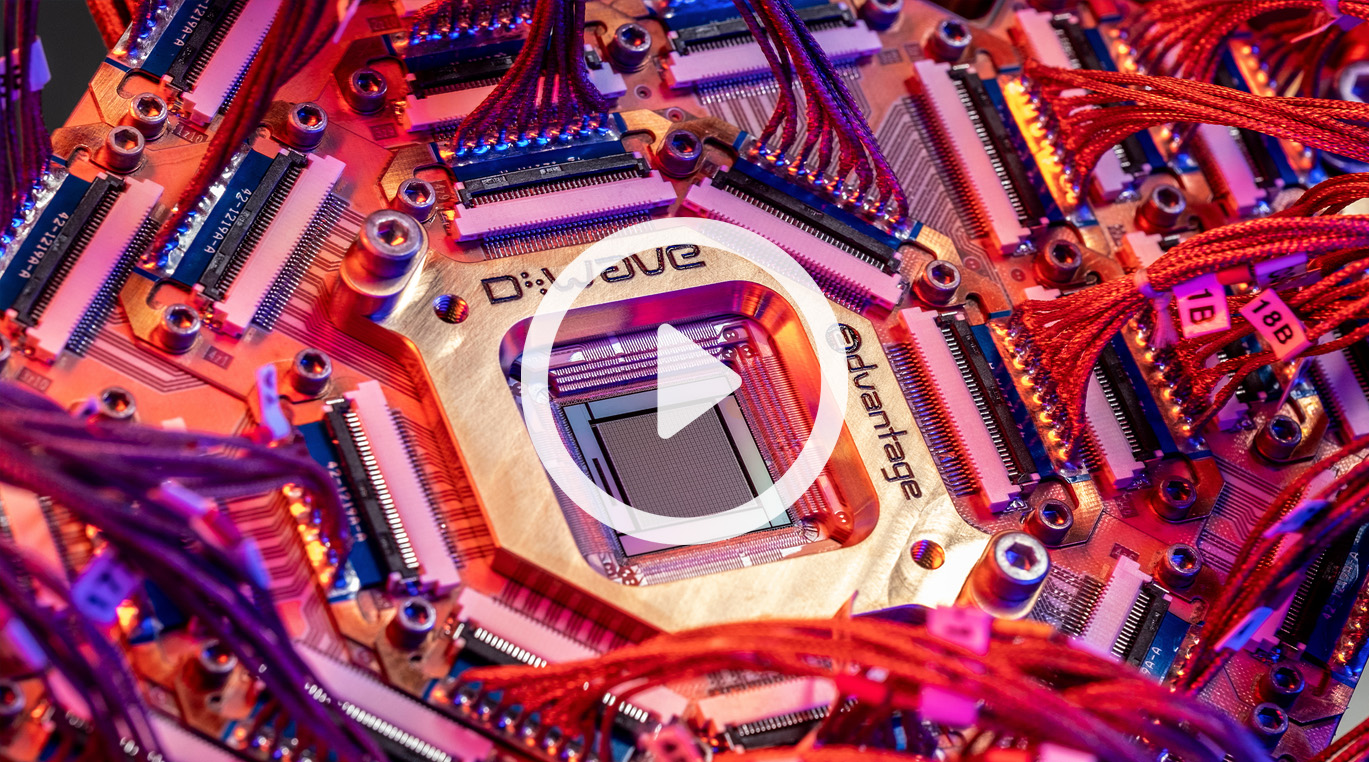

Let's start with the biggest flex of the week: D-Wave Quantum dropped a staggering $550 million in cash and stock to acquire Quantum Circuits. That's not exactly pocket change for a company whose revenue doubled to a whopping $3.7 million last quarter. The audacity of this deal is actually brilliant – D-Wave isn't just buying technology, they're buying credibility and a fast track into the gate-model quantum computing game that everyone else has been obsessing over.

Image source: D-Wave Quantum Inc.

The acquisition, which closed in January, came with immediate validation. A Fortune 100 company signed a $10 million, two-year Quantum Computing as a Service agreement, and Florida Atlantic University committed $20 million to install an Advantage2 system. That's $30 million in fresh contracts while analysts are still debating whether quantum computing is commercially viable. Wedbush was so impressed they raised D-Wave's price target to $40, joining Canaccord and Rosenblatt at $43. Nothing says "we believe" like institutional price targets that high.

IBM's Nighthawk: Because Why Not Add More Qubits?

Meanwhile, IBM is quietly doing what IBM does best – methodically building actual technology while everyone else chases hype. Their new Nighthawk processor, featuring 120 qubits and a 30% complexity increase over the previous Heron chip, is now available to premium customers. IBM boasts 2,299 qubits available across their systems, which sounds impressive until you realize they're still figuring out how to make them all work together without the universe collapsing.

The Nighthawk's improved inter-qubit connections (20% better, if you're counting) mean IBM can handle larger, more complex workloads. This is the kind of incremental progress that doesn't generate headlines but actually matters. While D-Wave makes splashy acquisitions, IBM keeps stacking qubits like it's playing a very expensive game of Tetris.

The Geopolitical Panic Button

Oh, and did we mention Congress is freaking out? House Science Committee Chairman Brian Babin warned this week that the US risks losing its "quantum edge" unless it maintains investment and strengthens supply chains. Ranking Member Zoe Lofgren dropped the reality bomb that China invested four times more in quantum R&D in 2024 and announced a $138 billion fund for emerging technologies.

Nothing motivates American politicians like the fear of falling behind China. The National Quantum Initiative reauthorization is suddenly bipartisan priority number one, which is hilarious given that we're talking about technology most of them probably couldn't explain to their grandchildren. But hey, panicked funding is still funding, right?

The Numbers Game Everyone's Playing

Here's what's really driving this frenzy: McKinsey estimates the quantum computing market could reach $100 billion by 2035. Astute Analytica projects over 30% CAGR through 2031. Those are the kinds of numbers that make investors salivate and venture capitalists lose all sense of rational risk assessment.

Image source: D-Wave Quantum Inc.

D-Wave's stock has surged nearly 400% over the past year, giving it a price-to-sales ratio of 275. That's not a typo – it's nearly 28 times higher than the tech sector average. Either quantum computing is the most transformative technology since electricity, or we're watching the most spectacular bubble since... well, you know.

What Actually Changed?

Strip away the hype and panic, and what's genuinely new in the past 72 hours?

- Commercial momentum is real: The Fortune 100 QCaaS deal signals enterprise adoption beyond experimental phases

- Academic validation is growing: Universities are now committing real money to on-premises systems

- The competitive landscape has shifted: D-Wave's acquisition fundamentally changes its competitive positioning against IBM, Google, and IonQ

- Government urgency is accelerating: Congressional hearings and funding priorities are moving from theoretical to urgent

- Hybrid approaches are gaining traction: The line between classical and quantum computing is blurring as companies offer integrated solutions

The Bottom Line

Quantum computing in 2026 is like the internet in 1995 – everyone knows it's going to be huge, but nobody's quite figured out how to make money from it yet. The difference this time? Governments, corporations, and investors are throwing money at it with significantly less patience.

The next 12 months will separate the genuine innovators from the opportunistic hype-mongers. D-Wave's aggressive strategy, IBM's methodical approach, and China's massive investments suggest we're entering the phase where quantum computing stops being science fiction and starts being actual business.

Whether that means your password is about to become obsolete or you're just going to see more quantum buzzwords in quarterly earnings calls remains to be seen. But one thing's certain – after this week, pretending quantum computing doesn't matter is no longer an option.

Comments ()